1. Introduction

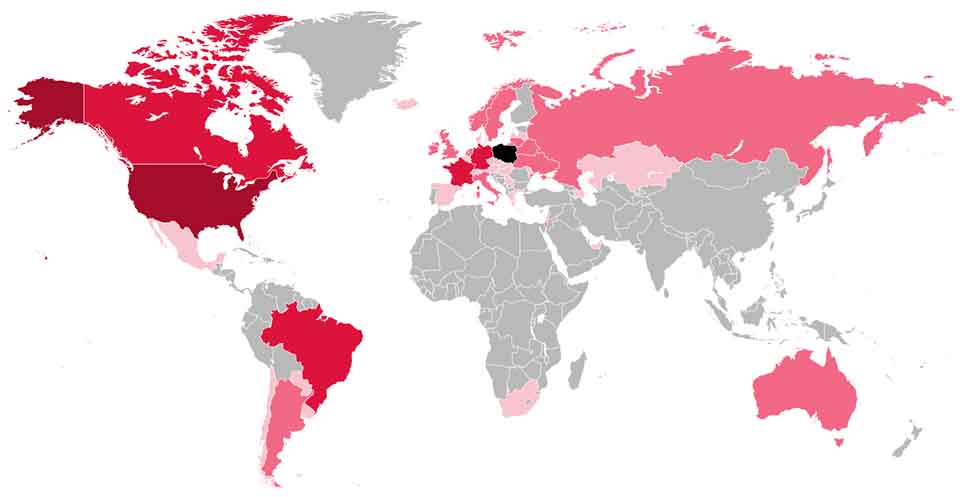

The Polish diaspora's capital—financial, social, competency, and soft power—remains one of Poland's least utilized development resources since 1989. The Polish diaspora in the US, Canada, the UK, and Europe possesses significant investment potential, reaching tens of billions of dollars annually. However, the lack of coherent tools, stable communication channels, and predictable incentives means that most of this capital never reaches Poland.

The aim of this article is to present a comprehensive strategy that will enable attracting Polish diaspora capital to Poland by building lasting mechanisms, institutions and programmes in line with the best practices of countries that effectively cooperate with their diaspora.

Photo: Alexander Mils (Source: Unsplash)

Over the past three decades, many Central and Eastern European countries have recognized their diasporas as strategic political, economic, and cultural assets. Contrary to the traditional approach, which treated emigration as a demographic loss, modern governments have begun to build new models of state governance with the participation of their citizens abroad.

Finances and potential of Polonia

In the first quarter of 2025, the Polish diaspora remitted approximately PLN 2.86 billion to Poland. By comparison, in all of 2023, the total amount of remittances was approximately USD 6.43 billion, almost half the record level in 2008 (USD 12.32 billion).

The Polish & Slavic Federal Credit Union, with 22 branches in the U.S., had $2.45 billion in deposits and 124,708 members at the end of June 2025—an average of over $19,600 per person. It's hard to overestimate the financial potential of approximately 10 million American Poles.

Demographics

The latest 2020 United States Census shows that 95% of Polish Americans were born in the United States, and 8,969,530 people claimed Polish ancestry—not out of compulsion, but voluntarily. Research over the past few decades has clearly shown that members of the Polish ethnic group are better educated than an average American. 43.5% have at least a college education or higher, compared to the American average of 33.1%. Americans of Polish descent are also wealthier than the average American ($79,000 vs. $63,000) in terms of family income; as many as 71% declare affiliation with the Roman Catholic Church, according to Polish Americans Today: A Survey of Modern Polonia Leadership, Piast Institute, 2020.

After the fall of communism, Polish political elites adopted a Warsaw-centric perspective, focusing on economic reforms, asset sales, building democratic institutions, integration with NATO and the EU, and implementing the Magdalenka provisions – which excluded the Polish diaspora from participation in the Polish public life.

In this context, the diaspora was deemed less relevant to the state's current challenges. At the same time, central institutions firmly believed that the Polish diaspora's role in the fight against communism had already been "fulfilled" and that its significance could be limited to a cultural and sentimental dimension. This shift in perception initiated a decades-long marginalization of the Polish diaspora's participation in Polish public life.

2. Diagnosis: Why does Polonia's capital not flow to Poland?

2.1. Lack of a stable and predictable institutional framework

Polish investors in Poland lack a single, professional point of contact. There are no dedicated teams serving foreign investors of Polish origin in their language and time zone.

In Poland, we work from 8 a.m. to 4 p.m., while Poles in the United States are just starting their day at the same time. Calling an office in Poland results in getting to voicemail. Responding to emails in Poland isn't exactly a strong suit, and planning is constantly last-minute. Even scheduling an interview at a reputable institution is still a feat. When we deliver important papers or analyses at conferences, Polish officials unfortunately have to leave because their workday is winding down, or they have another important meeting.

2.2. Insufficient level of trust and credibility

The Polish diaspora, especially in the US, expects transparency, clear state guarantees, verified projects, and stable law. The frequent volatility of regulations in Poland is a significant risk factor.

2.3. Lack of safe, professional investment products

The Polish diaspora expects tools similar to American funds, bonds, venture capital funds, and state-backed investments. Poland does not systemically offer such solutions.

2.4. Low level of information about investment opportunities in Poland

The Polish diaspora lacks regular communications, analyses, and investment projects in English. A modern narrative about Poland's potential is lacking.

2.5. Poor cooperation between state institutions and the diaspora

The current structures are not adapted to the expectations of foreign investors. There is no role for an "ombudsman" (an independent official, affiliated with parliament, to whom one can appeal in cases of violations of individual rights and freedoms after exhausting independent legal avenues) to represent the interests of Polish investors in Poland.

Moreover, polarization and dual power in Poland translate into a lack of transparency regarding the vision for cooperation with the diaspora, which should be bipartisan. Since 1989, Polish investors have been bounced from various doors, and their ideas, despite their uniqueness, consistently end up in the trash. The Polish political class uses empty slogans: "Polonia is the best ambassador in the world," or its own narratives: "Polonia is divided," or fads.

This season, "Polonia in Brazil" is all the rage. The fact that Polish has been the second official language (after Portuguese) in the Áurea commune in Brazil (Rio Grande do Sul state) since 2022 is a huge success for the local Polish community, which makes up 90% of the population. This allows for the use of Polish in public offices and the promotion of culture and is clearly causing excitement among Warsaw's Polish community experts. This initiative is part of a broader effort to preserve Polish cultural heritage in Brazil, where over 1.5 million Poles live.

3. Strategic Goals

Goal 1: Attracting new private capital from the Polish diaspora to Poland

Increasing the annual inflow of Polish diaspora investments from the current marginal levels to USD 1–3 billion annually within 5 years.

Goal 2: Building a lasting institutional infrastructure for cooperation with the Polish diaspora

Professionalization of services for Polish investors by creating specialized structures, dedicated financial products and legal tools.

Goal 3: Map of Strategic Industries and Investments

Strengthening the state through Polish diaspora investments in:

- energy and technological transformation,

- Polish startups and innovations,

- high-value production and exports,

- regional and academic projects,

- technologies of the future.

Goal 4: Rebuilding trust and the image of Poland as a reliable partner

Modern communication addressed to the Polish diaspora in the USA, Canada, Great Britain, and the EU.

4. Key Elements of the Strategy

4.1. Polonia Investment Desk – one entry window for investors

A “professional point of contact” structure that:

- operates 24/7 between Poland and the USA,

- provides English-language services,

- draws an investment map of Poland,

- coordinates administrative processes,

- conducts audits of projects submitted to the Polish diaspora.

Desk is the foundation for building trust, reducing risk and improving communication.

4.2. Diaspora Bonds – Polonia Investment Bonds

Modeled on Israeli solutions (Israel Bonds: Pioneering Diaspora Investment Development Corporation for Israel, DCI) and Indian solutions (India Development Bonds, IDB).

Product Features:

- issued by BGK or PFR,

- available only to people of Polish origin living abroad,

- attractive interest rates,

- state security,

- funds allocated to strategic projects.

The result: quick and safe capital acquisition of USD 1–2 billion per year.

4.3. Polonia Venture Capital Fund

A professionally managed fund that:

- invests in Polish startups and new technologies,

- enables Polish communities to co-invest,

- ensures professional supervision and due diligence,

- lowers the entry barrier: from as little as USD 5,000–10,000.

Goal: to combine Polonia's capital with Polish technological potential.

4.4. Matching Funds Program – the state co-invests with the Polish diaspora

Mechanism used by Israel, Singapore and South Korea.

As part of the program:

- the state injects PLN 1 for every PLN 1 invested by the Polish diaspora,

- the public sector takes over part of the investment risk.

Priority industries:

- energy,

- biotechnology,

- deep tech,

- high-value agriculture,

- digitization of industry.

4.5. Polonia Business Gateway – digital investment platform

A one-stop-shop platform with the following features:

- database of verified investment projects,

- business partners in Poland,

- access to experts, lawyers and advisors,

- analytical tools,

- training for investors,

- possibility of remote investment implementation.

The aim is to facilitate the quick and safe entry of Polonia's capital into Poland.

4.6. Polish Business Angels Abroad – a global network of experts and mentors

A network of Polish entrepreneurs and investors who:

- conduct pitch & review sessions for startups,

- evaluate investment projects,

- support the development of companies in Poland and abroad,

- build the prestige and ecosystem of Polish innovations.

4.7. Tax and legal benefits for foreign investors

Recommended solutions:

- preferential taxation of investment profits for Polish emigrants,

- partial tax exemptions for capital repatriation,

- simplified procedure for opening companies (English-language forms, e-signature for the Polish diaspora),

- special investment zones for projects of Polish origin.

4.8. Safety certification of investment projects

Introduction of the “Polish Diaspora Investment Certification”, which:

- confirms the legal and financial verification of the project,

- minimizes the risk of fraud and unprofessional intermediation,

- builds the credibility of the Polish market.

4.9. Access to Polish financial institutions via telephone from abroad

Currently, access to most Polish banking services from the US is impossible because Polish banks have not signed agreements to provide services from the US. Access to Polish bank accounts is not possible because they do not send text messages to the US. The situation was much better with email login, but this is currently impossible. Furthermore, Polish banks are reluctant to send even bank cards to the US. This needs to be resolved as soon as possible.

Purchasing shares, such as those Do Rzeczy, is only possible through international institutions, and access to purchasing shares in Poland is only possible with a Polish phone number. Therefore, Poles living abroad are unable to make such transactions.

5. Communication and Image Building Strategy

5.1. Kampania „Invest in Poland – Polonia Edition”

A modern campaign addressed to the Polish diaspora in the USA, Canada and Europe, including:

- films, podcasts, webinars,

- English-language materials,

- positive and professional message.

5.2. US and Canada Investment Roadshow

Government and economic delegations visit the largest Polish communities:

- Chicago,

- New York,

- Detroit,

- Toronto,

- Houston.

The goal is to build direct relationships.

The Association of Poles in Texas, led by Krzysztof Gajda, organized and financed such a trip for a group of professors from the Catholic University of Lublin (KUL). From June 28 to July 5, 2025, a delegation from the Patria Polonia Institute of the Scientific Society of the Catholic University of Lublin visited Texas, including professors Jacek Gołębiowski, Mieczysław Ryba, Przemysław Czarnek (former Minister of Education), Dr. Katarzyna Czarnek, Janusz Bień, Bartosz Rybak, and former Consul General in New York Adrian Kubicki.

According to the OEC (www.oec.world), between May 2024 and May 2025, U.S. exports to Poland decreased by $175 million (14.3%) – from $1.23 billion to $1.06 billion, while imports increased by $96.6 million (9.28%) – from $1.04 billion to $1.14 billion, mainly from Texas.

5.3. Investment Reports and Bulletins in English

Regular updates on the market, investments and projects.

6. Strategy Implementation – Schedule

Stage 1: 0–6 months

- establishment of the Polonia Investment Desk,

- development of the Diaspora Bonds project,

- preparation of the Business Gateway platform,

- commencement of communication with the Polish diaspora.

Stage 2: 6–18 months

- launch of Diaspora Bonds,

- launch of Polonia VC Fund,

- launch of the Matching Funds program,

- first investment roadshow.

Stage 3: 18–36 months

- full implementation of the online platform,

- certification of investment projects,

- scaling Polish diaspora investments to the level of USD 1 billion per year.

7. Success Metrics (KPIs - Key Performance Indicators)

- value of annual investments of the Polish diaspora in Poland,

- number of Diaspora Bonds participants,

- number of verified projects on the Gateway platform,

- value of investments under Matching Funds,

- number of new companies founded by the Polish diaspora.

8. Summary

Attracting capital from the Polish diaspora requires not only good intentions and political will, but above all, professional tools, efficient state management, stable law, effective institutions, and modern communications. Poland can achieve success similar to Israel or Ireland in cooperating with its diaspora if it builds a comprehensive system of cooperation with them.

This strategy presents a set of tools that, when implemented together, can transform the Polish diaspora into a key investor in Poland's development. This creates a new model of relationships based on shared responsibility, economic benefits, and a shared future.

Global diasporas are playing an increasingly strategic role today – as investors, advisors, diplomatic partners, and experts. Poland can benefit enormously by building a modern model of state governance with the participation of the 20 million Polish diaspora. This means not only recognizing the historical contributions of emigration but also opening the country to global knowledge, capital, and networks of influence.

The Israeli, Irish, Indian, Lithuanian, Estonian, Georgian, Moldovan and Armenian models show one thing: a strong diaspora strengthens the state, and a state open to the diaspora becomes stronger on the international stage.

Translation from Polish by Andrew Wozniewicz.