"Business Retreats and Sanctions Are Crippling the Russian Economy " — is the title of a study by Jeffrey A. Sonnenfeld and his team at the Yale Chief Executive Leadership Institute at Yale University, which has just been published but hardly noticed by the mainstream media somehow.

The study by Sonnenfeld's team, which uses extensive and also unconventional sources of data, is one of the first comprehensive economic analyzes measuring the current economic activity and assessing Russia's prospects after five months of invasion in the Ukraine. It is based on real data, with a strong emphasis on the credibility of information sources, while virtually all other opinions on the effectiveness of sanctions to date, even by the otherwise excellent and well-recognized news agencies, such as Bloomberg, seem to be based, as hard to believe as it is, on... official Russian data!

Whom to Believe?

How naive one must be to take at face value the data published by the official statistical body of the Russian Federation (Federal State Statistics Service, Федеральная служба государственной статистики, Rosstat) in the face of the ongoing information war, where the Russian propaganda is on the constant offensive.

Let us recall that a few years ago Rosstat was subjected to direct political control by the Kremlin, through the Ministry of Economy, and it underwent a thorough "methodology change" in 2017. Putting it under the control of the Ministry of Economy practically guaranteed the occurrence of political interference, and the change of methodology certainly did not result from any real efforts to establish the truth about the state of the Russian economy. [3]

Russian publications are increasingly selective when it comes to providing information that the authorities in the Kremlin might find inconvenient. Unfortunately, the naivety — or worse, servitude towards Moscow — of a large part of Western analysts does not allow them to notice this and they take at face value the information that is evidently generated for the purposes of war propaganda.

"The world pays for the war in Ukraine"

Bloomberg, for example, became a source of defeatist forecasts and scared the public in a May article, under the fatalistic headline How the World Pays for the Ukrainian War, that Russia was actually fueled by the flood of cash that this "economic superpower" sweeps off oil and gas this year. The flood of cash supposedly exceeds as much as $800 million a day, and that only from oil and gas, warned Bloomberg, and as a result "[Putin's] coffers are overflowing with the revenue from commodities, which have become more lucrative than ever thanks to the surge in global prices driven in part by the war in Ukraine." [6]

According to Bloomberg estimates, oil and gas exports will bring Russia a record $285 billion in 2022. According to official Russian statistics, the federal budget's oil and gas revenues rose 45 percent annually in January, from 3.1 trillion rubles to 5.7 trillion rubles (57 billion to 94 billion dollars). It is worth repeating again: these are data for January this year, and these are Rosstat data.

The Washington Post echoed this — albeit in less dramatic terms — with the opinion of Fareed Zakaria under the alarmist title The West’s Ukraine strategy is in danger of failing. "It is now clear that the economic war against Russia is not working nearly as well as people thought it would." According to him, "The basic problem with the economic war against Russia, ... is that it is toothless because it exempts energy. The Russian economy is fundamentally an energy economy. Revenue from oil and gas alone make up almost half of the Russian government’s budget."

What is supposed to be the conclusion of this? "Western leaders should recognize that economic sanctions simply will not work in a time frame that makes any sense." — Zakaria writes. So, the sanctions should be abandoned altogether then...?

Rosstat May not Reflect Reality

First, the credibility of the sources of statistical data from which far-reaching strategic conclusions are drawn must be carefully assessed. Official Russian data are — under the most optimistic assumption — highly selective.

In the four months since it went to war with Ukraine, the Kremlin has blocked public access to an unprecedented volume of economic statistics.

writes Yulia Starostina of the Carnegie Foundation. [8]

Officially, statistical obfuscation is intended to "protect Russian companies and individuals from Western sanctions." However, it is more likely that the Kremlin is afraid of publishing data that reveal the full scale of the economic downturn or the amount of monthly war spending.

Many of the optimistic economic analyzes, forecasts and projections that have spread in recent months have one major methodological flaw: these analyzes draw most, if not all, of their basic evidence from periodic economic publications by the Russian government itself. [1]

Freely available import statistics can be really dangerous for the Kremlin. They shed light on a key problem for Russian producers: structural deficits resulting from the exodus of foreign suppliers, the collapse of technical and production chains, and the resulting shortage of components for items nominally produced in Russia. [8]

Another possible goal of concealing trade statistics is to prevent Western governments from getting an accurate picture of the scale of the covert imports of sanctioned goods, and to protect third countries supplying such goods to Russia, thereby avoiding secondary sanctions. [8]

Previously, Russian export statistics tracked the trends, volumes, and directions of oil and gas exports that are of key importance to the Kremlin and are now allegedly generating record surpluses. At present, such data is not available, and the estimates of energy exports are made on the basis of information from February and March this year, i.e. before the introduction of Western sanctions.

Finally, from May 2022, the Kremlin has deprived all Russian taxpayers of information on how the state is spending their money: the Finance Ministry has classified current information on all federal budgetary expenditure and the sources of financing for its deficit. In April, on the eve of this change, budgetary statistics showed a rise in Russia’s military expenditure of almost 150 percent (630 billion rubles, up from 275 billion rubles in April of 2021), with a fall of 18 percent in income from sectors other than oil and gas. It is now impossible to accurately track current monthly spending on the war, the economy, and social obligations. [8]

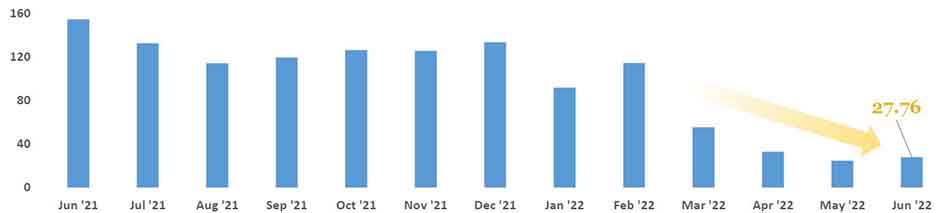

Russia monthly oil and gas revenue (Source: Yale Chief Executive Leadership Institute)

Three factors affect the credibility of the data on which many Western studies, analyzes and projections for the future are based: [1]

- The Kremlin's economic communications are becoming more and more selective, partial and incomplete. Unfavorable statistics are selectively rejected and only favorable ones are published.

- Even the favorable statistics that are being released are questionable given the political pressure the Kremlin exerted to spoil their integrity. The Kremlin has a long history of falsifying official economic statistics, even before the invasion.

- Almost all optimistic forecasts irrationally extrapolate economic information from the first days of the post-invasion period, when sanctions and business withdrawal have not yet taken place. Instead of the latest, up-to-date data from the last weeks and months, the latest available data, e.g. for March this year, are used.

Since the invasion, the Kremlin's economic announcements have become more and more selective, tendentiously rejecting unfavorable indicators while publishing only the more favorable ones, which are unreliable in themselves. These statistics selected and "corrected" by Putin are then carelessly published in the Western media and used by masses of careless "experts" hopefully with good intentions to make forecasts that are unrealistically favorable to the Kremlin. [1]

What Is Really Happening in Russia?

The study by Sonnenfeld's Yale team leaves no room for doubt: "The measures of current economic activity and the consideration of the economic outlook show [their] devastating effect on Russia." The withdrawal of Western business and the sanctions catastrophically paralyze the Russian economy. [1]

As the Russian invasion of Ukraine has been going on for almost six months, the widespread narrative that regularly appears indicates that the world unity in opposing Russia has somehow turned into a "war of economic attrition that is taking its toll in the West." As the Yale study proves, this is simply not true.

- Russia as an exporter: The perception of Russia as an exporter of strategic commodities has irrevocably worsened. Russia is losing its main export markets, primarily European, and is facing serious challenges caused by the propagandist "return to Asia." This turnaround will not be as easy to do as Putin puts it. For example, natural gas exports cannot be redirected to Asia overnight, as they require enormous financial resources, structural investments, and will take many years as a result. [1]

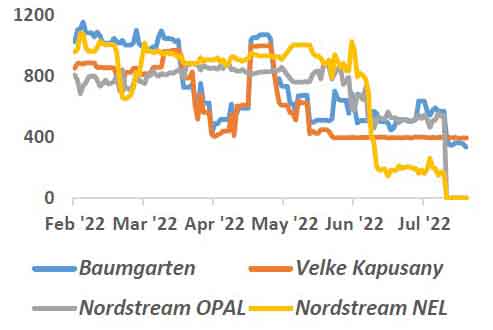

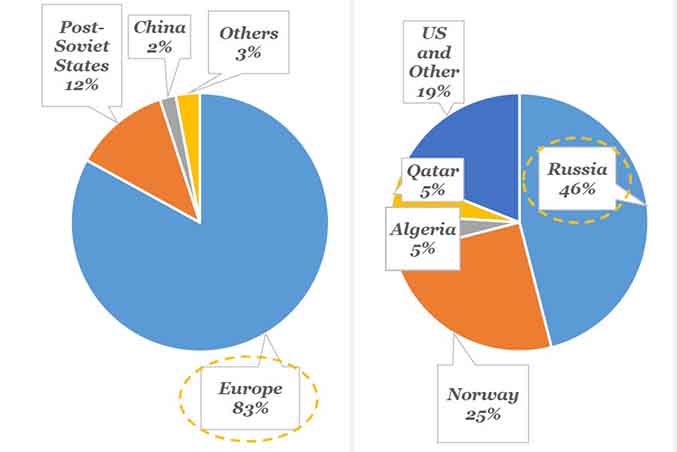

Russian Gas Flows to Europe [in GWh/d] (Source: Yale Chief Executive Leadership Institute)

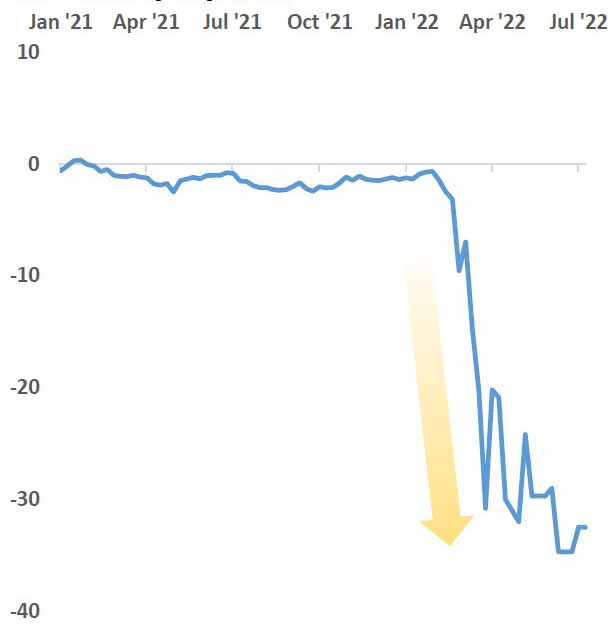

- Energy Exports: The situation with the export of goods already presents a much gloomier picture for Russia than commonly admitted. Total oil and gas revenues fell by more than half in May from the previous month, according to the Kremlin's own data. Russia's isolation from the West has destroyed Russia's strategic advantage in negotiations with China and India, notoriously difficult buyers who do not hesitate to use sanctioned countries to lower the price. China is notoriously enforcing massively discounted oil deals. [1]

Price differential between Ural (Russian) and Brent Oil Benchmarks; units: $USD, spread per barrel. (Source: Yale Chief Executive Leadership Institute)

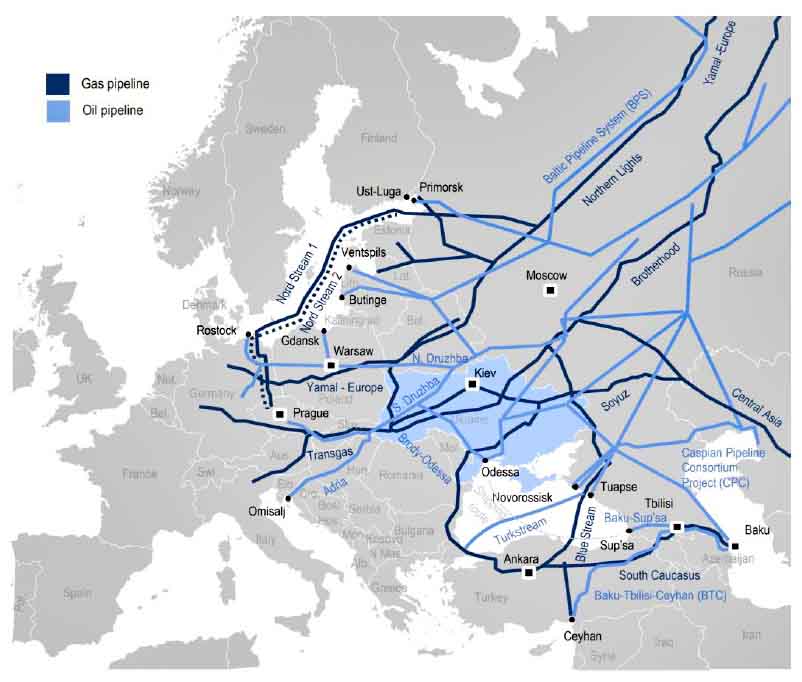

- Natural Gas Exports: Russian gas is transported through an intricate network of permanent pipelines connecting Western Russia with Europe. Many of these pipelines pass through Ukraine. Coupled with the recent closure of the Nord Stream pipeline, Russia's largest gas route to Europe (which operated at around 40% capacity prior to closure), Russian gas exports to Europe (and revenues from them) have dropped to a record low. [1]

Network of pipelines connecting Russia and Europe (Source: Yale Chief Executive Leadership Institute)

- Russia Depends on Imports: Russian imports have largely collapsed despite persistent sanction leakiness, and the country faces major challenges in securing key components, parts and technology from trading partners, reluctant to trade with the aggressor. This will lead to widespread shortages in the domestic economy. The scale of this problem can be seen even by looking only at Rosstat's official April data on industrial production. Compared to April 2021, car production decreased by 85.4%, lifts by 48%, washing machines by 59% and refrigerators by 46%. [1] [8] Many Russian manufacturers have to cannibalize and recycle parts due to lack of supplies from abroad. [1]

Russian gas exports destinations (left; shown as % of total Russian gas exports) and sources of EU gas imports (right; shown as % of total EU gas imports) (Source: Yale Chief Executive Leadership Institute)

Domestic Production: Despite Putin's delusions about self-sufficiency and the ability to replace imports, Russian domestic production has virtually completely died out without being able to replace lost enterprises, products, and human talent. With the decline in Russian imports, many domestic producers were unable to obtain supplies and materials for production. The weakening of Russia's domestic innovation and production base will eventually lead to soaring prices and consumer anxiety. In desperation, Putin effectively legalized the shadow economy and the infringement of intellectual property rights — even encouraged 'parallel imports'. [1]

Business Exodus: As a result of the withdrawal of Western business, Russia has lost companies representing about 40% of its GDP, reversing and thus negating almost all foreign investment in the last three decades. So far, over a thousand well-known companies have withdrawn from Russia, taking with them over 5 million well-paid jobs. [1]

Brain Drain: There has been an unprecedented flight of capital and people in a massive exodus of the Russian economic base. The latest wave of Russian emigration is over 500,000 people, at least half of whom are highly educated and qualified individuals, working primarily in the technical sector. [1]

Capital Flight: The official level of capital flight indicated by the Bank of Russia is likely to be grossly understated compared to the real one, given the strict Kremlin's capital controls restricting the amount of assets Russian citizens can take out of the country. However, even the lesser oligarchs are aware of the situation and are leaving the country en masse. More than 15,000 high-value individuals, with assets exceeding $30 million each, have already left, which is 20% of this group. According to all anecdotal reports, wealthy Russians flock to "safe havens" such as Dubai in the Middle East. [1]

Price Inflation: The official index of consumer prices in Russia hints at as much as 20% inflation, but that's not the full picture yet. Economic sectors most dependent on international supply chains, such as high technology, electrical appliances, electronics, cars and hotel services, experience 40%-60% of annual inflation. [1]

Russian budget deficit as % of GDP (Source: Yale Chief Executive Leadership Institute)

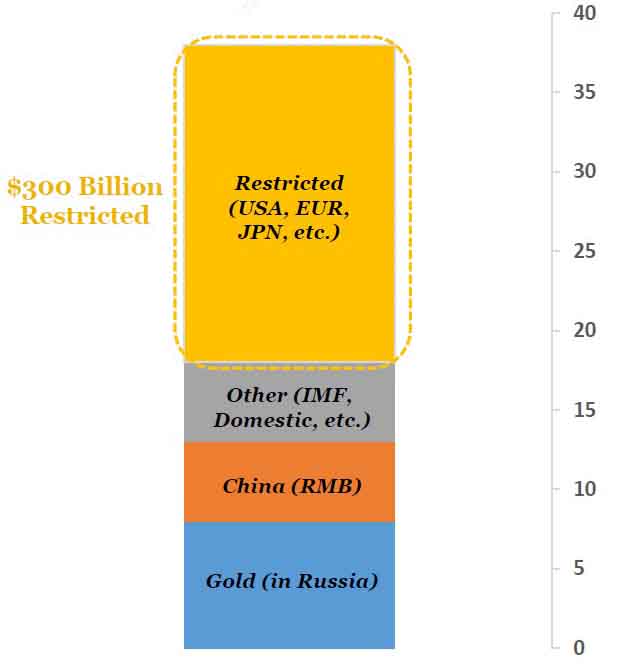

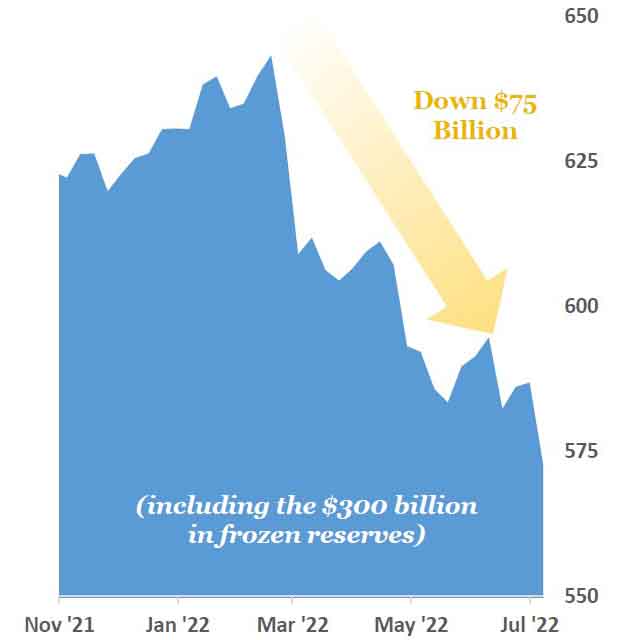

- Fiscal Interventions: Putin resorts to dramatic and unsustainable fiscal and monetary interventions to alleviate those structural economic weaknesses that have led his government budget to a deficit for the first time in years, and drain his foreign reserves, even as energy prices soar. The Kremlin's finances are in much more trouble than is commonly believed. Much of the Kremlin's rainy day financial resources turned out to be frozen in the West. [1]

Russian foreign reserve composition as % of GDP (Source: Yale Chief Executive Leadership Institute)

- Ruble Exchange Rate: The currency surpluses that allegedly exist in the sale of energy products are ever more difficult to spend, because there is a shortage of partners willing to trade. Hence the artificially high ruble exchange rate, which, in addition, makes it difficult to export Russian goods to those markets that are still willing to accept them. "Since Russia is now cut off from the international SWIFT banking system and blocked from international trade in dollars and euros, it is essentially left to trade with itself," said Max Hess, a lecturer at the Foreign Policy Research Institute in Philadelphia. [10]

Total Russian car sales by month (in thousands of cars) (Source: Yale Chief Executive Leadership Institute)

Financial Disaster: Russia's domestic financial markets, as an indicator of both current conditions and future prospects, are the worst markets in the world this year. This is despite strict capital controls. Prices on the Moscow Stock Exchange reflect the continued weakness of the economy. There are problems with capital liquidity and taking out loans. Moreover, Russia is essentially cut off from international financial markets, limiting its ability to use the capital resources it needs to revitalize its paralyzed economy. [1]

Technological Isolation: The technological isolation of the Russian economy will lead to a decline in living standards: technologies, cars, building materials and more will either be difficult to find or unavailable to many due to price increases. [1] [8]

Development Prospects: Without access to Western technologies and goods, Russia's technological development will inevitably be reversed, including in key sectors such as oil and gas. Secondary sanctions imposed by the United States will also limit the import of technology from China, deepening Russia's regression. [8]

The War and the Economy

It is simply in vain that we may look for any signs that could prove that Russia is returning to the path of reason and respect for international laws. Putin's Russia is obsessed with conquering of territories and conquering of nearby peoples — at any cost. The mirage of imperial power is the opium Putin serves to his electoral masses so they forget about incredible corruption, economic ruin, galloping inflation, social inequality, and political slavery.

Looking to the future, there is now no way back, out of a consistent policy of economic marginalization of Russia. It is altogether impossible to "get along" with Russia — the sooner the West understands this lesson, the lower the costs it will incur in the fight against the rashist imperialism. Russia must be defeated unconditionally, and economic sanctions must serve that purpose.

Extending the sanctions to energy carriers is indispensable for them to hit the most sensitive aspect of the Russian economy and thus be noticed in the Kremlin. Meanwhile, the situation is, let's say, ambiguous. The European Union in particular is in an awkward position — so far it has sent Russia dramatically more money to buy oil, gas and coal than it has given to Ukraine for aid. Many Western businesses and businessmen are still willing to do business with the regime of war criminals.

Russian foreign reserve over time (in USD billions) (Source: Yale Chief Executive Leadership Institute)

However, the defeatist headlines claiming that the Russian economy has improved are simply not based on facts — the facts are that the Russian economy is shaking at all levels and in all aspects, so now is not the time to back off sanctions. At the minimum, the sanctions must be extended and tightened further.

It is obvious that the economic sanctions by themselves will not win wars. We agree here with Fareed Zakaria of The Washington Post that "Putin’s real vulnerability is on the military front." [7] But any country's war machine is always largely based on the industrial complex and cannot function without its economic base. Therefore, comprehensive and severe sanctions are essential.

Winning on the battlefield will not be possible if it is not accompanied by a win in the economic field — and in the informational field, but that is a completely different story.